Self Defense Insurance

The explosion of the Concealed Carry movement over the past decade has also brought with it the Self-Defense Insurance market. Today, there are a handful of self-defense insurance options and as with any insurance program, there are pros and cons to each of them. In this month’s On the Hunt, we will highlight some of the most important aspects of self-defense insurance and shed some light on the pros and cons.

Payout

Probably the most important aspect of self-defense insurance is the payout process. Some companies are “reimbursement” payout process, which means you fund the upfront costs, and the company pays you back. The issue with a reimbursement style payout is that an insurance company may refuse payout if you are found guilty or if there are any questionable circumstances surrounding your case. The other payout option is an “upfront” payout. This option will cover your legal fees upfront,

regardless of the outcome to the legal proceedings. Unless you have the resources to potentially cover 100-200 thousand dollars of legal fees while you wait for reimbursement, your best choice may be choosing a plan that covers the fees upfront.

Coverage Limits

Obviously the higher the limit the better, but how much is enough, and is unlimited coverage necessary? In the self-defense circles, the number that keeps popping up is $100,000.00 even in a cut and dry self-defense case. Add in the potential for a civil case and the possibility that you could win the legal case and loose the civil case you could be looking at some pretty big numbers. Therefore, I think the minimum should be $100,000 of Criminal Defense fees and probably $1,000,000.00 in Civil Defense and Damages.

Attorney Selection

One of the big deciding factors for me is if I get to choose my own attorney or not. With some plans, the company simply assigns you one of their attorneys in your area to defend you in court. Other plans allow you to choose your own attorney. Since I already have an established relationship with an Attorney that regularly deals with firearms legislation and self-defense cases, I am going to pick a plan that will allow me to use my own attorney. If you don’t already have a relationship with an attorney you would trust to handle your case, it might be worth the effort to try

and find one in your area, otherwise you will have to settle for whoever the

insurance company assigns to your case.

Cost

Cost can be one of the biggest deciding factors for many permit holders. Self Defense insurance plans can range from as low as $130 to as high as $600.00 a year. While, lower cost options may provide adequate coverage, they may not include additional perks or coverages such, firearm replacement or theft coverage, bail bond coverage, spouse or family coverage, magazine subscriptions, additional training options or compensation for lost wages while in court. Sometimes the perks are

worth the extra cost, sometimes they are not, it really depends on your budget and perceived value of the perks. Additionally, some plans offer monthly payment options to help offset the higher annual cost.

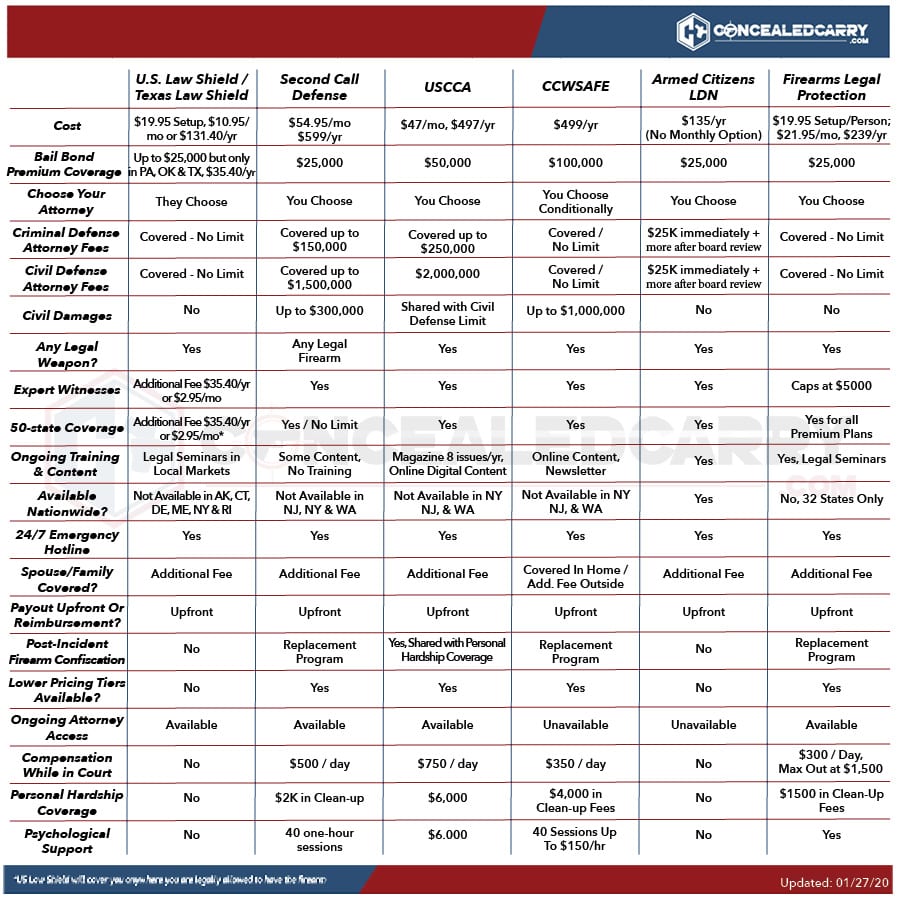

Below is a good comparison of the major Self-Defense Insurance Plans from

My Choice

My personal chose is the USCCA Platinum coverage program. I have been to the USCCA Headquarters in West Bend WI, toured the facility, and have worked closely with many of their employees. Additionally, the plan allows me to choose an attorney that I already have a relationship with. I am comfortable with the coverage limits, the monthly payment options, and feel the magazine and additional training material are invaluable part of the program.

Disclaimer – I am not an attorney, nor have I ever been in legal proceedings

surrounding a self defense case. Heck, I didn’t even stay in a Holiday Inn Express last night! Boondocks FTA™ is a USCCA affiliate and a portion of some membership sales may be returned to Boondocks FTA™, but as a USCCA Instructor and Training Counselor and an employee of Boondocks FTA™ I do not personally benefit from my recommendation. My opinion is solely based on my own evaluation of the cost, coverage and program options. I encourage you to do your own research before you choose.